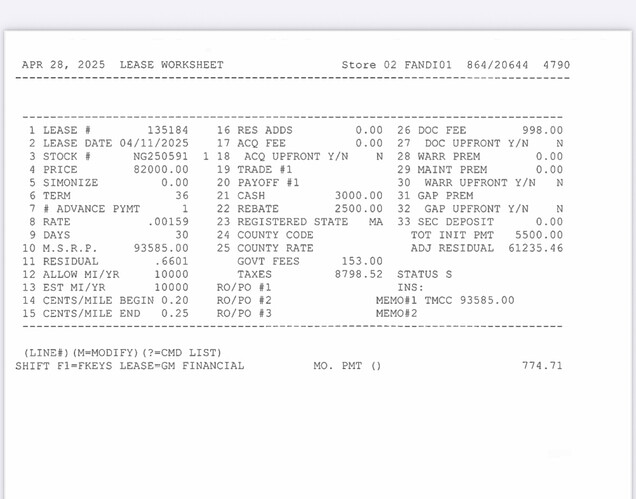

Chapstick isn’t as savvy as you think. Your posted dealer WS is garbage. You claim that the 8798 tax is capitalized is impossible b/c the adj cap must be 80984.36 in order to get a payment of 774.71 Recognize that…

Gross Cap = Sell price + capped amounts

Adj. Cap = Gross cap - cap reductions

Given that SP = 823000 with capped amounts of 998 and 8798 and a cap reduction of 5500 there is no way you can achieve an adj cap of 80984. In fact, you’ll be around 86300. The WS does not identify the cap reductions, or all amounts capitalized. I suspect that there may be other fees that weren’t disclosed.

You owe it to yourself to learn something about leasing; especially how to do all the calculations instead of relying on platforms like AI chapstick or online software. You’ll learn very little by relying on these tools.

FWIW-

Don’t waste time trying to decipher a dealer’s worksheet or allowing AI to do all your work. Dealers will eat you alive by allowing them to control the deal. They often omit a lot of relevant detail such as money factor, fees not itemized and even make mistakes. You need to rely on credible outside sources (e.g., LH marketplace and signed deals, Edmunds, etc.). Do your own research and establish a reasonable selling price in your market. Be sure to get a copy of the factory window sticker. Check for non-factory add-ons or dealer-installed options. And, if possible, eliminate those you don’t need or want. Get a list of all customer and dealer rebates/incentives including VIN#-specific discounts/incentives, if any. And, yes, the dealer has such a list.

The only thing useful about dealer lease worksheets is the input data. All data should be vetted such as acquisition fee, doc fee (regulated by some states), cost of money (e.g., money factor), gov fees, residual, rebates/incentives, sales tax rate, etc. Make sure the residual matches the term and annual mileage requirement. Check available tax credits/incentives via the fund provider who may cover taxes or, at minimum, may assess a lower sales tax rate to energize sales for some models (e.g., Texas).

Organize all relevant data with the goal of creating a lease proposal that reflects your target deal. The idea is to create your own target deal (proposal), not replicate the dealer’s deal.