I don’t use calculators except for those I developed. So, here is what I’ve generated using my Excel lease program given the data you provided coupled with some commentary…

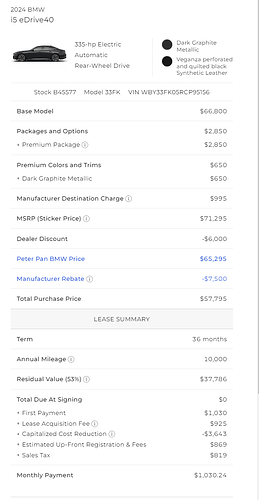

MSRP = 71,295.00

Res. Factor = 53%

Residual = 53% x 71,295.00 = 37,786.35

MF = 0.00285 (appears to be marked-up (check the buy rate on Edmunds)

Term = 36 mo.

Tax Rate = 9.00%

Sales Tax = 9% x (7500.00 + 925.00 + 675.00) = 819.00

It appears that taxable dealer fees amount to 675.00. Could be a Doc fee (seems high)

Given the 7,500.00 rebate, there are two allocations: (1) an amount allocated to a cap reduction and (2) an amount allocated to paying all upfront fees. The allocation in the dealer’s worksheet is not accurate and should reflect a 3,862.83 cap reduction (CCR) and 3,637.17 applied to all upfront fees (rebate credit). So, here is how it should align…

Sell Price = 65,295.00

CCR = 3,862.83

Adj. Cap = 61,432.17

Base Payment = 939.60

= .00285 x (61,432.17 + 37,786.35) + (61,432,17 - 37,786.35)/36

Lease Payment = 1,024.17

= 1.09 x 939.60

Upfront Fees

1st Payment = 1,024.17

Acq. Fee = 925.00

Reg. & Fees = 869.00

Taxes = 819.00

Total Charges = 3,637.17

Rebate Credit = 3,637.17

Total DAS = 0.00

The dealer WS is structured so that the rebate credit (not cap reduction) is 3,643 and the cap reduction is 3,681.29….

Serll Price = 65,295.00

CCR = 3,681.29

Adj. Cap = 61,613.71

Base Payment = 945.17

= .00285 x (61,613.71 + 37,786.35) + (61,613.71 - 37,786.35)/36

Lease Payment = 1,030.24

= 1.09 x 945.17

And, here is the problem…

CCR = 3,681.29

Rebate Credit = 3,643.00 (see WS)

TOTAL = 7,324.29

Do you see the problem? The total should be 7,500.00, not 7,324.29. I would ask the dealer what happened to the remaining 175.71. The allocation was inaccurate. They should either cut you a check for 175.71 or re-allocate as shown above.