It’s a Chrysler product that isn’t a wrangler, so low residual isn’t surprising. Add in that the current GC is over a decade old, and it’s really no surprise that the long term value isn’t there.

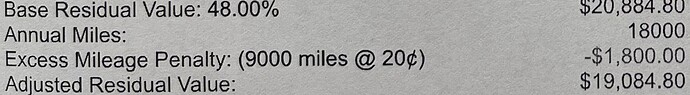

Gotcha, so are they giving me the benefit of a higher residual at 48%? I’m thinking of just going with 15k now but I was quoted at 48% residual for 15k, I’m thinking an error on their side.

No, they’re adjusting the residual accordingly

Because there isn’t an 18k program, you get the 15k numbers and then buy the extra 3k miles per year up front at 20 cents a mile.

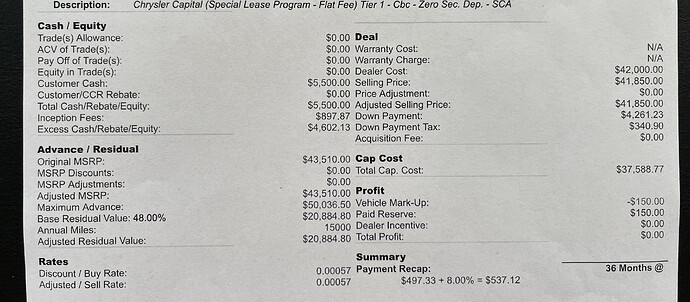

You have almost $5,000 worth of equity in the deal as cap cost reduction, the rest is being used to pay up front costs like tax, tags, first month. That’s worth about $138 a month. If you keep it out of the deal and take the higher monthly payment you can just put that money in a savings account or whatever and draw down from it over the course of the lease to make up for the difference in monthly payment. And if something happens to the car you don’t lose all that money.

That 48% residual effectively becomes 44% when they adjust it to prepay the extra miles to get you to 18k a year.

Yeah, that makes sense now. I probably going to just go with the 15k regular programming miles.

Do you need the higher miles? How much does Jeep charge for the miles if you go over at the end?

If this is a Chrysler lease it should be 25 cents per mile versus 20 cents if paid up front.

Can you explain further on the $5k worth of equity as cap cost reduction, I’m not following.

Equity is NOT an incentive. It is money out of your pocket.

My wife drives to work and her commute is far so that’s why I’m increasing the mileage. At this point, I’m probably going to go with 15k now and figure out overage later.

You are reducing the monthly lease payment by putting “cash down”, or capitalized cost reduction. Every dollar in cash down or rebates lowers the total capitalized cost of the lease, which lowers your monthly payment. The drawback is that you cannot get that cash back if the car is totaled, stolen, etc. If you don’t put that cash down your payment will be higher, but so what? You still have the money to use to make the payments on your own. And if anything happens to the car you still have that money left over.

You should be able to edit your thread title (if not I can edit it for you).

You can also edit the first couple of posts if you wish to make your current intentions clear.

Alternatively, don’t put the cash down and save it for overages, if any. If you indeed need 18,000 miles per year that would end up costing $2,250 at the end of the lease.

I understand now, makes sense. The higher payment drove me to put more $$ down but I see your point.

Here’s the second worksheet the dealer gave me. The $5,500 is the rebates which is being used for DAS, etc. Any input on this one? This is no money out of my pocket.

No, this is a terrible deal for a GC.

The quality of the deal is identical to before, you’ve just adjusted your cash out of pocket amounts. This is essentially the same horrible deal of full MSRP on a decade old grand cherokee.

It’s almost 4% off sticker which isn’t great but I’m not sure how deep a dealer will go on one of these nowadays.