Hello everyone, I have been doing a lot of research on the forums and I believe I have an understanding but I just wanted to clarify a few things in calculating. How should I be calculating taxes?

2019 Honda Civic Coupe Si - 36/12k : IL

MSRP: 25,230

Sales Price: 22,716 (Quoted through email)

Residual: 15,390.30

Tax: 6.5%

Misc Fees ~ 500

I’m able to put down 2,000 towards the sales price bringing it down to 20,716.

Monthly Depreciation (20,716 - 15,390.30) / 36 = $147.94/mo; Total Depreciation = $5,325.84

Monthly finance (20,716+15,390.30) * .00186 (Quoted from Edmunds) = $67.15; Total Interest = $2,417.4.

Total Base Payments = 5,325.84+2,417.4 = $7,743.24

Do I calculate tax off of my total payment? Or is it off the sales price

Right now I have pre-tax monthly to be 147.94+67.16 = 215.09/Mo

What would be my monthly after taxes?

Did I do my calculations correctly? I have used the calculator, but I just want to be able to do this by hand preferably.

I am just trying to get a close estimate so I can begin negotiations.

Thank you everyone!

Don’t put anything down. The typically very menial savings in interest is more than offset by the risk of losing that entire down payment if you total the vehicle or it’s stolen. Also, you need to pay your sales tax up front on any cap reduction or roll it into the lease - putting cash down counts as a cap reduction.

You’re missing all of your fees in the calculations (unless you are paying them up front), they need to be added to the cap cost.

Monthly sales tax is based on the pre-tax monthly base payment.

1 Like

Okay, I’ll factor that in

Okay thank you for the help

So I just made a quick excel worksheet to organize my calculations. This is what I have, does anything look incorrect? I can clarify if needed.

Thanks

1 Like

Looks good to me. I would also add a row for customer rebates and another for tax on cap cost reductions, in case you look at a vehicle with rebates.

1 Like

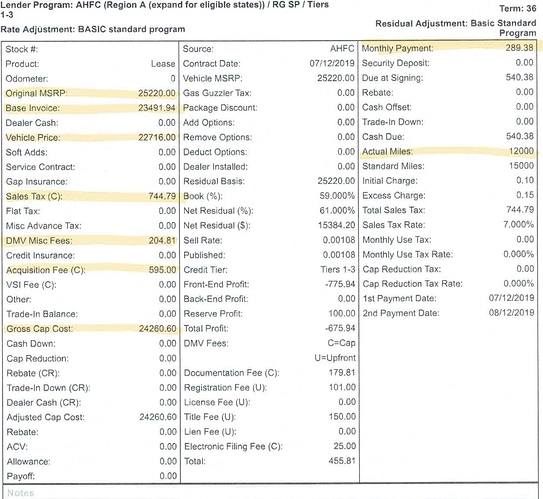

I just received this quote from the dealer. Is there anything that is jumping out as wrong? Any input will be helpful!

Thank you

What is the reason that the Gross Cap Cost is jumping back up to 24,260.60? Vehicle price is at 22,716. Am I missing where they added $1000 in fees in there somewhere?

Thanks

The drives doesn’t cover all the DMV fees so some of that is capped along with the acq fee and some taxes.

Is the gross cap where it should be then?

There’s $744.79 in sales tax. So if that’s accurate for your tax area then that’s correct. You’ll need to verify how your taxes are calculated. The $595 acquisition fee is correct.

Okay thanks. Yes taxes are correct. Is getting my monthly down to 250 with 0 cash down realistic?

You’re at $750 DAS and $289/month. To get to 0 drive off and $250, you’d need to find another $3000 off. I think that’s probably a stretch.

Okay thanks. Does this quote look like a good deal then?

There must be other dealers that you can shop this quote around to? That’s usually how you grind down the final few dollars.

1 Like

In IL, I think you might be able to get a better deal. You could ping @ralphsaphony and / or reference his thread: July 2019 Honda Deals - Chicagoland Area

1 Like

So just as an update, this is the current quote I have. IMO it looks great and I will be picking up the car this week! Please give me feedback!

MSRP: 25,220

Vehicle Price: 22,300.87

College Grad: (500)

Acq. Fee: 595

Gross CAP: 22,395.87

Residual: 15,384.20

MF: .00108

DAS:~750 (Doc Fee(179.81) Registration Fee (101) Title (150) Electronic Filing (25) First Month Payment ~(250))

Monthly Pre Tax: 236

Monthly Post Tax: 252

I left some wiggle room in DAS just incase, but the payment is within $5.

I’m really happy I found this forum. Last week I was quoted 350, 2000 down from my local dealer