So will it be like the X5, $3000?

I believe so. For the lease the dealer gets the $4600 and they pass along the $3000 to the leasee.

Good to know dealer is making 1600+ on that deal, can be used in negotiation. They are realy trying to get these x540e s off their lots

I don’t think the dealer gets the extra $1600… BMW Financial Services does AFAIK

It is the dealer getting the $1,600 or BMWFS? I thought when you lease the owner is BMWFS. Unless they are kicking some or all of the $1,600 back to the dealer, which is certainly possible, the dealer wouldn’t get a dime of that money.

It all goes to BMWFS, they put heavier incentives on the electric leases though.

My bad. Dealer won’t care then.

Don’t forget - HOV stickers in CA!

Definitely already on that!! The link for those that are in Maryland is

http://www.mva.maryland.gov/_resources/docs/VR-335.pdf

Didn’t realize that the 530e made the carpool cutoff. Figured it would be like all the other BMW plug-ins and not have enough electric range to make it.

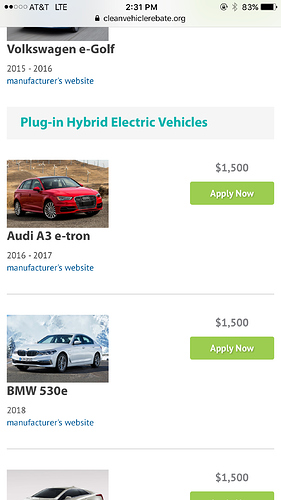

Anybody know if you can stack that clean vehicle rebate?

Stack with what? It’s a rebate you apply for after purchasing/leasing, so the dealer/manufacturer has nothing to do with it.

Sorry, I didn’t quite follow here. Is this tax credit in addition to the $7500 federal credit or are you talking about the same thing (but a diminished credit now because BMW manufactured 200k EV’s etc.)?

I would have doubled down on the 530e if they made an AWD version.

The CVRP is a CA rebate, if you qualify based on income, and is separate from the $7500 federal EV rebate.

They are offering an X-drive version of the hybrid, if I recall correctly, for the new 5-series.

I do believe there is a xDrive, meaning AWD.

So…

did anyone get a deal doing this yet?