IDK the CUs policies, and I’m not super familiar with cars with damage, accidents, or marks on title. I will defer to people with experience in that matter. Also this conversation is assuming OP has t1 credit.

Sounds like you only checked with dealers. You need to check Carvana, Carmax, vroom, shift and whatever else. You can do those online for a few minutes each. They’ll show exactly how much they’ll ding you for the carfax report.

I guess things can change in 4 yrs, but, if they are paying 9% interest, I would assume they don’t have Tier 1 credit?

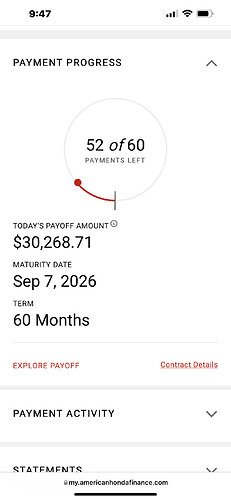

How many months left?

Oh wait, are you saying you have $30k left to pay at $730 a mo? Thus about 41-mo left?

All due respect, unless you’re in a significantly improved financial position, do you really feel you need to upgrade to a brand new $44k car?

If you have $3,500 to spare, make a lump sum payment to principle, no? You’ll save on interest and you’ll be in the same position regardless if you later decide to trade up (ie roll $6500 NE and no down vs $10k NE and $3500 down).

Either way I’d try refinancing.

I’d keep trying to make extra payments as extra funds allow and keep improving credit. A 2018 TLX has plenty of life left in it. Will cost you less in depreciation/maintenance than a lease payment on a 2022.

I don’t need a 44k car no. I was browsing around. My credit isn’t that good as it was years ago. One bank was willing to refinance it but at 12% 560$ a month.

Holy cannoli man. $30.3k is just your current principle/payoff. Taking this to term will be more like $38k.

Throw every dollar you comfortably can to pay this down, forget the idea of getting a new car. Just do what you can to keep improving your credit and refinance once your credit is sufficient to net you a lower rate.

You wanna buy gap insurance. Then park your car next to the ramp on a lake and forget to put it in park…

Plan includes “free” food and a place to stay too?

Don’t you worry. Has GAP Insurance

So the joke went over ur head.

He’s saying to ‘accidentally’ leave it next to a lake and let it roll in so the insurance company can total it, as it’s negative. AKA snowy off-ramp, accident to disappear negative equity car. Which we’re totally not reccomending as that is a very unethical thing and constitues basic insurance fraud.

You should “prefer” a 1999 Corolla. Keep making these bad financial decisions and 10k of negative equity is going to seem like you won the lottery.

It’s about to be summer, so thats why I suggested a lake. Otherwise, snow off-ramp it is…

That being said, I know anyone who has ever pulled this ‘trick’ off successfully. YMMV

Almost ![]()

![]()

![]()

Fook that guy that happen to be recording

OP - you need to pump the brakes and think things through. There is a lot going on here, with several seemingly poor decisions. LH is often willing to help, but it is also a family of tough love. This is a disaster. Your wallet is on fire and you’re pondering which grade of gasoline you should pour on.

You bought this car in the past 8 months?

**originating loan amount, not necessarily what the car was purchased for.

Correct, it could be all in with tax, or it could be net of a down payment meaning it was even higher. Can’t know for sure without knowing from the OP.