PLUG just announced they’ll post their revised financial reports within the next 5 days. I was riding them high when it popped in late Jan, was up 120% (+$25K) and now down $10k. Gotta hold it, 2022 and beyond.

We all know how the nasdaq trades, down 18 days then new highs in 3 days. We have seen it over and over and over and over again. The markets are extremely overbought but it seems buyers alwsys step in after a simple 3-5% drop and back up it goes again.

We’re also in a bit of a bubble where you have 30 million + people with access to stocks from the retail side. That being said I have been using most my liquidity for crypto and also setting cash for when this market takes a poopy, everything is way too overbought as you’ve said. I personally feel there will be great buying opportunities come end of year.

@Yanoosh Yeah, i’ll be honest I short most the stocks I see tiktok’ers shilling, there’s other stocks for exposure in EV charging industry; just my opinion though…

I cant stop buying up $VYGF every dip, I think I have an addiction doc

what do u think about ADA/Cardano?

I don’t know anything about them honestly. I’m gonna check it out now as all my crypto buys came the same way, just from someone talking about them.

I just got very lucky with timing the crypto markets and have always been anti federal reserve/fiat so made sense to dump cash into it. Never thought it would take off the way it has though. Global insecurity/money printing by all nations really made it pop. Took me awhile to abandon precious metals and buy crypto as I was stubborn. Still love buying commodities but crypto isn’t seemingly going anywhere. I’m playing with house money if it does anyway.

I still don’t trust it. I still think it’s a darpa initiative and big banks/govt are 100% behind it. They’re testing out global currencies and acceptance of it. So whatever happens was meant to happen. It’s not an organic movement IMO, just another attempt in avoiding the inevitable crash from not having sound money.

As @Jrouleau426 said it, you put the money you can afford to loose.

I’ve stayed away from crypo craze since that 2018 crash. I did though buy up few companies that deal with bitcoin mining. CAN, RIOT, and MARA.

Well that’s because you entered during a bear market after a crash

. If you just held on to it you would be singing right now

. If you just held on to it you would be singing right now  , that being said you would of known the bull cycles with a little Google search. Not saying this year is different, although it is, there’s hundreds of catalysts that are sparking this perfect storm situation I don’t know if we will ever have a bear market for crypto like we normally cycle through. Either way I’ll be holding most my stuff 5-10 years easily…

, that being said you would of known the bull cycles with a little Google search. Not saying this year is different, although it is, there’s hundreds of catalysts that are sparking this perfect storm situation I don’t know if we will ever have a bear market for crypto like we normally cycle through. Either way I’ll be holding most my stuff 5-10 years easily…

Why it’s important to do lots of research before blindly going into it though.

@Jrouleau426 you need to check out VeChain/VET.X - (supply chain blockchain and just struck a huge partnership with Salesforce). Supply chain CRM and block chain supply chain technology.

AKT.X Akash Network - defi cloud computing for blockchain, essentially the only of its kind, extremely valuable and important going forward (also yields 56% APR interest for staking any coins)

LINK.X chainlink - essentially it’s the linking of all blockchain information, very vital and important to the successful communication of all blockchains.

ADA.X cardano - isnt bad it’s essentially a faster ethereum, same cocreator as ethereum, but they haven’t put out smart contracts or anything in regards to their promises for the ecosystem of cardano. I have some cardano but probably my smallest holding

ONE.X Harmony - have developed blockchain technology that allows them to send and process money up to $1,000,000 and send it in 0.0002 seconds for 0.0001 the cost (my numbers might be off slightly but you get the idea). Going to be incredible for future ACH and wire transferring, huge project I love.

DOT.X polkadot - web3 project and huge scalability, they’re like chainlink but slightly different in that they allow smaller tokens and blockchains to communicate, allowing interoperability and transactional scaling and communication between other tokens and blockchains.

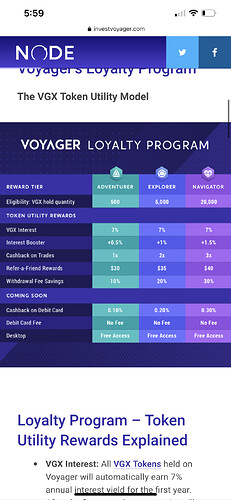

VGX/voyager token - this is an exchanges token, but if you take a look at binance and their personal coin you can see how insane their value can go up, especially when you add smart contracts and the ability to use margin and increase your interest rates through their loyalty program. Personally this coin is what I’m stacking the most of up… former e trade CEO trading arm Steve Ehrlich is voyager’s CEO and he’s been incredible, only publicly traded crypto exchange before coinbase. Coins up 21,000% which never hurts  and it has 7% APR.

and it has 7% APR.

USDC stable coin - this yields 9% APR and it’s a $1=1 coin stable coin, my grandpa and dad like this cause they just enjoy slow 9%, but they’ve started to branch out into other coins once they saw the compounding effect of coins increasing in price on top of paying you interest in the “like” coin.

My personal favorites and long term holds. My precious metals essentially… thanks for coming to my Ted talk.

Edit: Sorry I forgot ETH.X but that’s a given and a 10 year hold. I earn 6.5% interest on this also, everyone kind of knows about eth so. There’s some other alt coin projects I love but I won’t get into those another time.

Through geometric sequential logarithmic buying it’s kind of foolproof and losing money in crypto is nearly impossible unless you’re doing something wrong. Every time I hear of someone losing money it’s because they were flipping for fiat or went in blindly and didn’t DCA or use logarithmic buying.

Max out 401k every March 15…dole out $3-4k into both kiddos 529’s…then begin funding my long term FET hold at the market. I play the oil super cycle every few years, thats the winner going forward from here. Any other funds are for commercial real estate/storage building downpayments

Nailed that one today. Crazy reversal from premarket drop. The “smart money” that gets the rumor ahead of everyone else makes a killing on these days.

Free broker fee on that cardano tip if you ever need a yota! Thanks for that threw $5k in

I have been in ADA and Matic/Polygon since the .30 range both coins are moving.

@cyak you using voyager for USD Coin

Yeah I forgot to put matic, always forget it’s in my coinbase pro and I never use that dump, love the polygon project tho, been holding since January so was good to see it come to fruition.

Yes I use voyager for USDC to hold most my cash that was in my bank account, since I have at least 500 voyager tokens (I have more thats just the minimum requirement for their loyalty program). So I get a boost of 1.5% extra on most my interest rates with voyager, so my USDC is 10.5%+ among other benefits.

I tweet the CEO sometimes (he actually replies it’s actually pretty cool) and they’re looking into adding terra USDT for 20%, just a better stable ecosystem compared to USDC, so hopefully that happens soon!

Very cool I use BlockFi will have to look into Voyager. BlockFi has changed since the day I got it and many complaints are the limitations in growth offerings.

Can you withdraw whenever or is it set terms? Crowdfunding is interesting I just see people’s credit issues daily and I’m not bullish

Obv it’s not fdic insured not that I have faith in that anyway

BlockFi you can withdraw whenever it’s daily compounding.

Yeah most know blockfi since it’s been around a bit longer, I’ve personally really loved my experience with Voyager; they’re doing things properly and methodically since they’re publicly traded. I’m honestly viewing them as my future bank, they just struck a big deal for Market Rebellion and themselves for futures, equities, margin, options, etc… https://finance.yahoo.com/news/voyager-digital-market-rebellion-form-130000258.html

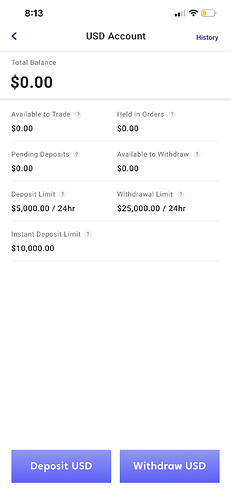

@Jrouleau426 you can withdraw anytime, as long as the funds have cleared of course. I would say all the major coins except for a few can’t be withdrawn, only downside and it’s a few specific coins, but most can be. BUT you can move your coins to your voyager account to start earning the interests, it’s paid out monthly so nice compounding effect. As far as cash withdrawing to your bank you can at anytime and on average it took 2-3 business days to transfer, I’ve tested it multiple times to be certain. They have a cap on withdrawals at $25k/24hr and deposits limits at $5k/24hr and instant deposit limits at $10k… that’s my only hang up, I get why though it’s to make sure they don’t run into insolvency issues or bad money coming in etc.

Mr bro told me about when it was .30 I had about 15k laying around he told me to put in ada and hold. Well I wish I took his advice then but I got in at .70ish and again at .90. He says it’s a easy $10 in near future and say just buy $10-$20 a week or month whatever I can afford at the time. (He nerds out pretty hard so my brain starts smoking and overheating 5min into it lmao  )

)

Haha…don’t beat yourself up over it I owned bitcoin at $5 and then again at $200. Hell I have owned most of these meme coins at low points and after small fundamental moves I sold them. I have learned to toss funny money in and forget it until it becomes the next pumped dumpster fire.

Yeah I don’t know man. I don’t trust any of it. They appear to be even less liquid then the phony tbtf banks.

3.6% of reserves are cash? It’s just another ponzi that’s gonna crash eventually imo. It could be in 10 days or 10 years. But it will happen. I wouldn’t put more then I was willing to lose in it. I’ll stick with my antiquated gold and silver bars/coins.

Actually it’s 2.9% cash. 3.6 is cash and cash equivalents…

This is incredibly poor disclosure for a business with $40b+ of assets. You can’t make any assessment of the liquidity of the credit risk of the these financial instruments fromi these charts. Who are the issuers of the CP? What is the their credit rating? Maturity?

https://www.theblockcrypto.com/post/104780/tether-usdt-reserves-breakdown-first-time-since-launch

Yeah I mean you’re going into tether stuff and maybe that’s why some use USDC currently over it. I’m speaking more on just Voyager exchange specifically, but did you read the entire article… it’s just them being transparent; the title is “click baity”. All they were stating in the article is that it’s not 100% backed by cash and that they have other securities backing it up, they were explicitly stating they wish to be as transparent as possible as they promised? UST is still superior to USDC from strictly a tokenomics standpoint

You can distrust all you want, obviously your risk tolerance is your own personal tolerance. People have been using these services for years.

So you can buy your gold and silver I’ll buy my scammy internet coins (I have stocks/indexes also), obviously it’s your money at the end of the day  .

.

I’ll continue to make my magic internet money from interest yields, but I also don’t view crypto as ways to earn fiat. I view all my buys based on interest yield farming and/or coin count. Buy and hold until Bitcoin stock to flow is 100 in 2024 and Bitcoin is 500k