Please explain with bright orange crayons your misfortune with out of warranty 3 year old trannys.

I’m out of warranty on a cvt Altima, pray for me.

Didn’t Nissan extend the CVT portion of the warranty to 100,000 miles?

Bear

They did, and I’m covered by that. But, breaking down on the side of the road is what scares me.

I hope your ok.

I rented a 2017 Altima SL with 39,000 miles and drove 800 miles one-way to pick up a 19 Mustang GT Convertible and beat the crap out of it and it seemed to be holding up well.

If a rental car is holding up, yours should be fine too.

Bear

‘15 Altima S 45k, my mom bought it and took my dads RAV4 in the divorce, she traded my custody for it, ironically it’s now mine.

Not to be a naysayer. I really hope the market holds up, but I have my doubts. But I don’t think Manheim is an accurate picture, and the graph does not help. So here is how they describe the graph:

“Specifically, each day’s MMR Retention equals average auction sale prices divided by average MMR across Manheim’s entire marketplace.”

So they are using their own auction sale prices, which drive MMR Retention in the first place, to support their MMR Retention number. HUH? The bigger problem I see is that a great number of cars I try to look up give me this message:

“Not enough MMR transaction data available to generate a value.”

Soooo… not enough data to give a value, yet they are claiming strong values using their own minimal data vs their own averaged data. Kind of like using my own neighborhood to judge the economic well-being of the entire country, isn’t it?

That Manheim Graph just shows that used car prices are getting back to where they were a couple of years ago. It shows how inflated used car prices had become.

What does the Y axis represent in that graph?

It’s a used car price index weighted for car mileage, age, and vehicle class mix.

If you really want to know, here’s some links:

https://publish.manheim.com/en/services/consulting/used-vehicle-value-index.html

https://www.economy.com/united-states/manheim-used-vehicle-value-index

Calculation

- Eliminate outliers

- Calculate average miles and average price for each model year / make / body.

- For each transaction calculate price and mileage deviation.

- Outliers are defined as those where both price and mileage are outside of 2.6 standard deviations.

- Calculate mean sale price and mileage by market class

- Adjust prices for mileage

- The per mile adjustment is based on a simple linear regression for price and miles for each market class based on data for the current month.

- The mileage differential used is: current month’s average mileage by market class minus average mileage for that market class over the past 24 months.

- Combine prices across market classes

- The Index is weighted based on a 24-month rolling average of past sales by market class.

- Note: In the original version of Manheim Index, market class averages were sales-weighted to a total based on fixed weights that represented unit volumes sold in calendar year 1998.

- Seasonally adjust using the latest Census Bureau method

Hertz just missed their lease payments. If they’re forced to dump some of their inventory on the market, it will push prices lower.

Thanks. Interesting. So it is simply an index. What I can’t figure out, though, is what it is based on. For example, if it is dollars per transaction, then you’d expect it to rise due to inflation and the increasing price of vehicles over time. I would THINK it adjusts for inflation to counteract this, but I don’t see if/where they state that.

ANYWAY, this is interesting and kind of illustrates what I was saying about that awful Retention graph. They admit that the MMR will drop to meet the declining values, and therefore using MMR Retention is useless because it exists only to prove itself.

"It should be noted that, given the unprecedented downturn in sales and market disruption that the industry is experiencing because of the COVID-19 pandemic, the decline we have observed thus far in MMR values at the vehicle level and at all aggregation levels does not fully reflect the declines occurring in the relatively limited number of sales transactions taking place. Adjusting MMR for retention, which is the average difference in price relative to current MMR, results in a decline of 11.9% for 3-year-old vehicles since the end of March.

The MMR retention gap is narrowing as MMR values catch up to the declines observed in the limited transactions occurring."

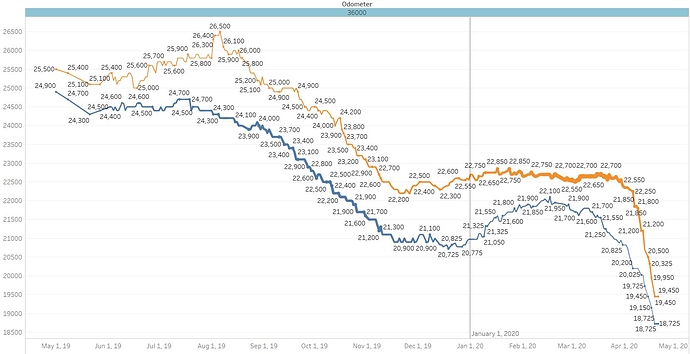

Here is the daily MMR view of Grand Cherokee Limited V6 at the national level. The blue line is the price point of 2016MY and the orange line is the price point of 2017MY. The thickness of the line indicates the volume at auction. Miles are held constant at 36k and the condition is held constant at a 4.0CR (out of 5.0).

So anyone who is sitting on off lease volume of this trim is most likely going to hold off on selling them in today’s wholesale market. Retail prices through this time frame have remained consistent in the 25k-27k range fro Jan through Mid March and are now in the 24k-26k range, which means dealers still able to move them (at a low velocity) without needing to discount them too much.

Once the dealers sell out of their current used inventories of this model, they will then go back to the auctions to buy more. That is when the wholesale lines here will rise back up to the 20.5-22k range. With the retail prices in the 24-26k range, a 60mo loan payment at 2.99% (above average in today’s climate) the payment will be in the 450-500 range, depending on the sales tax rate. The demand for loan payments in this range is stable since you’ll have a lot of people coming out of 500-600/mo lease/loan payments who will want to jump down a tier and still find the Grand Cherokee an acceptable replacement vehicle.

This is just one example of a high lease penetration vehicle with a very high amount of data. As soon as you start doing this analysis on a lower sample size vehicle, you need to get a little creative to come up with an accurate price prediction.

So much conjecture and BS in several posts on here.

Auction sales are down so much that the sample sizes are super low and many recent sales aren’t even included in the Manheim or ADESA numbers overall as outliers. The auctions were almost at a relative halt, picked up a little for digital (although many buyers and sellers had already gone digital) and now are picking up again. Wholesale prices are down 10-12%, used inventory is higher (100 days vs. 40-50 days) and retail pricing on used is down only 1% because there are no buyers and the need to fire sale isn’t there yet.

The time to trade in was 2/15-3/15, the time to buy used is now through most likely the end of the summer. For sellers/trade-ins, now you either wait it out until fall or take what you can get at this moment - especially if you are looking at new, the dealer has a lower inventory and can make some magic happen with your trade and backend support on the new unit before the flood of lease returns is on their lot prior to being shipped off to auction.

If you are a wholesaler with a used car lot or a pre-owned SM at a dealer, then all of this means something to you. If you are an individual with a trade or looking to buy, then if the $1k-$3k swing on your deal is a really that big of an issue then you need to make some different life choices. For likely 90+% of the people on these forums, this information does not affect their livelihoods but rather is factored into the cost of the purchase or sale happening, on average, once every 3.2 years. The ups and downs of your cost/sale are generally meaningless on average in all the purchases and sales you will make in 78.5 years of life expectancy (unless you are a dealer’s dream and get clowned on every deal you make). The bad financial and other moves made with regard to credit cards, housing, vaping, hookers, divorces, job choices, education, women/men, diet, alcohol, legal bills, healthcare, drunken sailor spending and whatnot are far more expensive than the $3k you lost or made because of the car market and your deal.

Sorry, but I am saying it.

Now I understand why you have been scarred for life. Being picked over a RAV4 is not easy to get over. At least if it had been a Porsche Macan…

Guilty on seven counts your honor! Most of them starting with an h

Thanks for taking the time to explain the data. Your insights are always appreciated.

You don’t know half of it  , being a divorced kid means my passport and papers have become pawns in a game of international chess, my mom relocated to China last I heard, and she keeps trying to get me to ‘visit’.

, being a divorced kid means my passport and papers have become pawns in a game of international chess, my mom relocated to China last I heard, and she keeps trying to get me to ‘visit’.

If it had been a Porsche, man I wouldn’t be butt hurt at all, but alas, ‘‘twas not.

Who is lining up to buy ex-rental cars? More subprime customers?

BHPH probably.