Now, let’s find the fine print about one pay and totaling the car (default event) lol

Annoying BMW calls it “GAP” (all caps)… but it’s specifically not insurance lol. It’s basically the TLP that thevolvoguy was talking about in the meme thread.

The latter link looks like every other captives’ GAP product.

Why did you pay for it?

Yeah:) I hope tomorrow new programs start rolling in and we will start discussing next unicorns.

I just got off the phone with BMWFS and MBFS and reading through my lease contracts (California). Apparently the two have very different policies on this funky topic (at least for California).

But first… a disclaimer. remember that I don’t read too good and most of my posts are in the meme thread. And some TH think I have bad pants on because I don’t like to finance inventory with equity.

For BMW-FS, the lessee has to get an optional GAP product sold by BMW if they want to be protected from a situation where a total loss from the lessee’s insurance pays out less than the lease payoff amount. However, at the same token, should the lessee’s insurance pay out more than the lease payoff amount, that overage would be returned to the lessee. This means on one-pay or instances where a large cap-cost-reduction (DAS) were made, it’s possible to get a portion of those up-fronts back. However, it’s not an exact linear relationship, the up fronts could be wiped out if the insurance company doesn’t pay out enough.

For MB-FS, they confirmed the lease has a built-in Gap Waiver. If the vehicle is totalled and the insurance payout is much less than the lease payoff amount, the lessee does not owe anything. However, the downside is the inverse means if the insurance payout is greater than the lease payoff amount, the lessee gets nothing. The lessee would need to tell their insurance company to bifurcate their disbursement to pay MB-FS the lesser amount and pocket the excess amount directly. This means if a large cap-cost reduction (edit: ignore what I said about one-pay) were made, the lessee could basically lose everything if they aren’t wise to things since technically there is no value being returned to the lessee if the insurance pays it all to MB-FS first.

Neither would answer my questions about MSD being used to cover “losses” or “defaults” because the phone support folks didn’t have an answer to them. I suspect it’s possible for MB-FS or even BMW-FS to use MSD to offset their exposure to their possible losses in the Gap Waiver.

What sucks is MB-FS doesn’t offer what BMW does to allow a lessee to buy into some form of GAP or TLP. It basically makes any form of (edit: whoops mjr_kong corrected me) large-cap-cost-reduction with MBFS a terrible idea from a total loss perspective (if your insurance company is unwilling to bifurcate their disbursements for a total loss… or if you think MB-FS is massively propping up the resid and the vehicle is immediately underwater like an EQS).

I also feel like any MSD program with Mercedes is just asking to have a bad time should the vehicle be totalled.

This has always been included (for free) on BMWFS leases. They are now making it an optional, premium product?

For my lease, they said the only way to get it is to pay for it. My standard lease contract language makes no mention of GAP or anything related to it.

I was told a rider (separately purchased non-insurance product offered by BMW) was necessary. That link I posted above also cites it as an optional, premium product.

It basically makes any form of one-pay or large-cap-cost-reduction with MBFS a terrible idea from a total loss perspective

In my MBFS contract section 20 I see the following language that pertains to one-pays:

If this is a single payment lease, you will receive a refund equal to your lease payment divided by your Lease Term (as shown on page 1 of this lease) times the number of months left in this lease at the time of the loss of the vehicle.

One-pay is back on the menu! I told you I don’t read so good.

But I think a large cap-cost reduction is still a bad idea. And MSD is still in a grey zone… which makes me think the only “safe” bets in event of a total loss are almost zero DAS or one-pay I guess.

Does insurance pay for retail or wholesale pricing? You can get probably same EQS used for like 30-40% off after a year

Have you seen etrons? Literally 50% off after a year

Hey, I read for you !

I didn’t go for one pay with the first EQS exactly because I was scared of this, but then I read the contract. Got second one via onepay.

I just re-read through my i4 contract as well. There is no GAP and discusses Adjusted Lease Balance depending on the insurance pay out.

I added GAP from Progressive for $8.69 for 3 months as a back up until I get reassurance on this.

The sales manager did also say that BMW included GAP, but no so sure right now

How did you get Progressive to add Gap to your car that was being leased instead of purchased? IIRC there was a mega-thread earlier this year about how adding Gap insurance on leases wasn’t possible…

Huh maybe Eric51 was onto something…

Yeah if I look at the latest retail pricing on BMW i4, it’s above my lease payoff amount. I can’t say the same thing about Mercedes EQS hah.

HHAHAHAA I thought about that idiot too

GAP for leases definitely exists as an insurance product. Some of the products they don’t offer on leases are stuff like new car replacement riders.

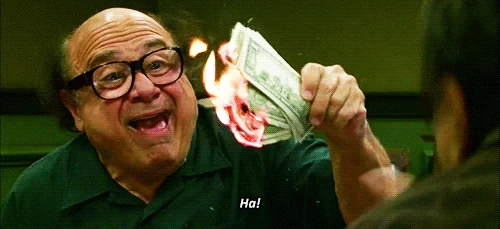

Yah currently in the positive $5k ![]() I can light 2 lattes on fire

I can light 2 lattes on fire