I would if i score one under 300 with no money down. Fun beater to go to work. Dont wanna put too many miles on my truck looking to flip once EV comes out

I don’t understand the hate on Tesla here. Yes, my plan is to get in another one. The fact that they had no injuries while car is totaled is a big plus in my mind.

My wife and child were in the car when they got rear ended. If they were driving a less safe car, they almost surely would have been injured.

My payment was $520+tax, $0 down. 15k miles. This is the highland upgrade 2024 version, lot of new features vs older model 3. Ya, it’s not a killer deal, but with the gas savings and auto pilot, it’s a winner for me.

Edit: Just priced the same car and saw the lease payment is $432/mo. 15k miles. with $0 down. So, ya, I suppose this is a blessing, now I can get the same car for cheaper payment.

Just ignore it; two sides to the coin. Some here have multiple teslas, some have been burned by Tesla and switched to EQ’s, and some have EQ’s and are getting burned ![]() all sorts around

all sorts around

If you like the M3, go for it. It’s gets way more fiercer and snippish on the Tesla forums ![]()

And glad everyone made it out of your ordeal ok ![]()

I take Ariya for under $300.

Hopefully there a BOGO Sale ![]()

Good call.

You should be able to log into your account and see a payoff or lease balance?

Santander will not give payoff to me. Instead, they want GEICO to create a settlement letter and payoff guarantee letter and submit to them. After that, they review the value GEICO estimates and later negotiate the payoff with GEICO, I assume. My guess is this is done because you cannot purchase this Tesla at the end of the lease, it must be returned.

I sure hope they don’t go demanding some crazy number. Based on my own calculation, the payoff should be around $42k, give or take some fees.

The balance of payments = $18,000

Residual value = $23,400

Total: $41,400

Can the leasing company (santander usa) ask for more than this amount?

Hey i think your stressing this out, you got nothing to worry, you got full coverage you will be fine. You got your self out of a tesla, and your alive without getting hurt. Enjoy the rental untill you get a confirmation letter that car is sold.

Ya, the reason I am stressed is b/c the other party’s insurance is saying the policy limit is $50k. Therefore, they told me they will not cover any claim if the costs approach near $45k, including rental car.

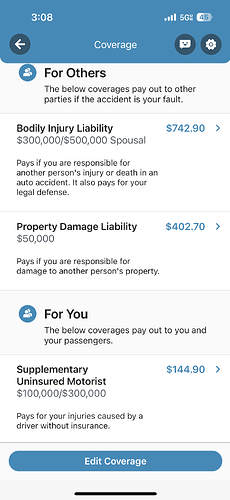

As of today, they have declined to even cover my rental for fear it may put them over $50k policy limit. My policy limit is $100k, so I know I will be fine if I use my insurance, but as of now, I’m working with GECIO, the at fault drivers insurance.

So, I understand that my insurance will take care of me, but I am hoping not to to have to go through that again, since I have been dealing with the other guy’s insurance now for about a week. Also, I have to pay my deductible if I go through my own policy, and they don’t guarantee that I get that back. Also, my insurance said they only cover $900 worth of rental car max.

I wouldn’t get a Tesla, but I can understand why some do. For the most part, you can better cars for the same price and you mentioned gas savings and autopilot. Any EV would give similar savings and as for autopilot, IMO HDA II, Merc, and BMW are better. Great that everyone walked away and if you end up getting another Model 3, cheaper payment. Has insurance said anything about your premium increasing?

Can someone explain why everyone doesn’t just have a low policy limit if it’s apparently fine?

You shouldnt be paying deductible. I went through this when i totaled my g37, same story about the other guys insurance. If your not at fault youndont need to pay

Get yourself a rental, cause its coming out of the other insurance company too

That’s where your underinsured kicks in and your insurance may try to recoup them by suing the other party directly. This is one of the benefit having full coverage, use it.

I’m sure each state and situation are different… and of course I’m just a shitposter on LH… but my understanding is that having only $50k of coverage opens the offender up to personal liability if MrKool44 decides to file a claim for damages in excess of the insurance limit.

Also, having only $50k will probably mean this rear-ending-a-Tesla policy holder is going to get their coverage dropped after this event, and they will struggle to find a new insurance carrier later.

In NorCal, the general recommendation for moderate to high earners is to bump up the vehicle insurance coverage to a point where it makes economic sense, then fill a gap in with a personal umbrella.

Whoa damn, I hope that is an annual premium you’re looking at…

No 3 cars full coverage, me and my wife have points, been sued hitting a pedestrian. Total a car, lol Geico always been there for me.

They let you have different limit for bodily injury vs uninsured underinsured. They don’t let me do that. Btw, you should add property damage liability to min $100k with car prices these days.

To protect your assets. ( Replying to comment above)

True, ill look into tonight see the difference