That or Lightstream even

You got yourself into a bad situation when you bought the Mitsubishi

Rather than fix it, you made it worse when you refinanced it at 19% for god knows how long

So rather than pay this down and get right, you want to parlay into a brand new car and wash away your negative equity with an EV credit from a TikTok post.

Then you got trolled with a unicorn hornet deal @ $65 a month and think that they just fall off of trees.

Couple of things:

all of these deals are predicated on tier 1 credit. Interest rate of 19% suggests less, and saying your credit is “around” 700 means to me something with a 6 in front of it. You need at least 720-740 minimum for tier 1.

You are late to the party. Inventory dwindling and tax credit expiring, many cheap EVs already gone. You probably don’t qualify for all of the rebates on the hornet but good luck. Sometimes people get lucky, but most of the time, it takes a few weeks to work a unicorn deal, if you ever even get one.

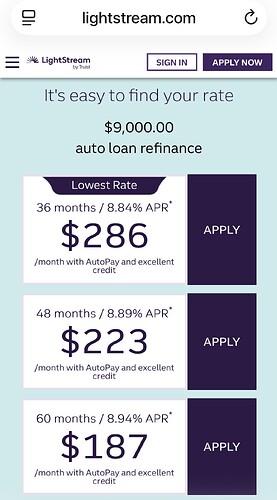

So, my advice, like has already been told to you, is to try and pay down the mirage, or refinance it at a better rate, it is not that old and is simple car. Even with minor repairs and maintenance, it will probably get you to the end of the note, then reevaluate your finances.

This is not an option due to LTV limits. No bank will lend him, say, $9k for a car that’s worth 3.

A Hornet might actually work if he can afford the 24m payments but he needs to calculate that first.

No one trolled him. I showed him what was possible. Then made it clear, that even at $150/mo he could be in md-400s, and that he should hire a broker.

Appreciate it ![]()

Thank you for this. It may have been silly of me to go into this thinking I could come out better. I got rolled up in it a bit. A broker could be the way to go If things don’t work out right. I do see though that inventory is dying down a this time . I see some of these AMAZING deal working out at 24mo esp if I can get a decent trade in value it would make this realistic

Again, big picture, you don’t even have 6K saved up to get you out of your current situation but now you are going to get into a new contract for 2X or more than the 6K…is your long term income secure? Have you explored how much your insurance is going to go up with a new car (it will be a lot for you I bet)?! What if rent goes up? Can you live a few months if you get canned from job? I just think buying a new car is the last thing you should be thinking about…