Exactly. Missing the forest for the trees.

What should happen doesn’t matter here. They told you via that quote that they don’t value you as a customer. If anything they implicitly told you they are willing to rip off anyone who doesn’t know better.

You know better. Move on.

The most important educational experience here is knowing how to search for data points on pre-incentive discount percentage and applying them to a personalized LH calc, then making offers. Anything else is a waste of time until one has mastered that.

Agree! But try convincing @pizza8822 of that.

Ah, yes it does. As @HersheySweet stated…

So, in this case, the MF for the monthly and the one-pay are one and the same, namely, .00001. I didn’t realize it until he mentioned it. I saw that happen once before.

@max_g You are absolutely right, I do know better, I am moving on. This originally started with me asking this dealership if their ‘discounted price’ online included the rebates. I didn’t approach this correctly. Live and Learn!

I agree. However, they structured it as a one-pay. My best guess for not using the rebate as a cap reduction is b/c it would be subject to 938.26 tax. If it were structured as a traditional monthly payment lease, your payment would be…

Base Monthly Pay = .00001 x (47894.92 + 35629.20) + (47894.92 - 35629.20) /24

= 511.91

Monthly Pay = 1.06276 x 511.91 = 544.04

Lease Inception Fees…

1st payment 544.04

CCR Tax 938.26

DAS 1482.30

That’s around what I was coming up with. I didn’t save my calculator numbers, but that seems spot on to what I was seeing.

I’m not a fan of calculators preferring, instead, to perform my own calculations. You can be certain that they’re spot-on.

I’m in N. Ridgeville. Where are you from? Love the INDIANS logo. Bring it back!

By rolling it into the monthly the way they’re doing, it still is being taxed. It is just captured in the monthly tax.

Are you kidding me? No, it’s not. Look at my monthly payment calculations in my posts above. Nowhere is the 938-tax captured on the 14950 rebate. The intent all along was to structure this as a single pay where the rebate was applied upfront.

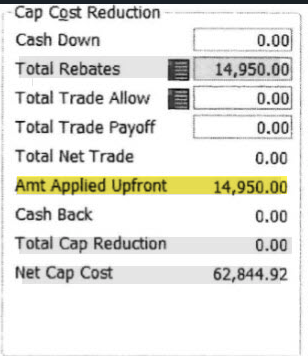

SP + Capped Fees - CCR = Net Cap

SP = 61348.22

Capped Fees = 1496.70

CCR = 0

Net Cap = 62844.92

No 938 rebate tax here. BTW, note that capped taxes = 0.

But the tax on this is calculated prior to the reduction, which means it’s being accounted for inside of the monthly.

If they’re charging tax on the entire amount pre-rebate reduction, that means the amount reduced by the rebates was still being taxed. Which is the same as taxing the rebates. Is this SM actually a genius?

The math does not support your claim. Unless you can show me the math, I think you’re grasping at air. Look at my payment calculations. Calculation of the monthly is straight-forward…

Base Monthly Pay = .00001 x (62844.92 + 35629.20) + (62844.92 - 35629.20) /24

= 1134.97

Monthly payment = 1.06276 x 1134.97 = 1206.20

The rebate tax is not subsumed in the net cap. There is nothing hidden.

Again, show me the math. Honestly, I think you’re over thinking this complicating it more than it needs to be. FL taxes the base payment. The tax on the base payment in no way captures the rebate tax. Just look at how the base pay is calculated. the sales tax rate is applied to the base pay to determine the monthly pay. That, too, does not capture rebate tax.

I’m guessing that many posters are seeing the 62844.92 instead of 47894.92 which reflects a difference of 14950. Therefore, they wrongly believe that the 14950 difference ultimately gets taxed when nothing could be further from the truth. Again, the 14950 is applied upfront. and does not get taxed. what gets taxed is the 11234.97 base pay.

I doubt the SM is a genius otherwise, he’d be selling $15000 toilet seats to the government making 40%. Of course, the politician’s cut would be their customary 55%.

WHEW! I’m tired. You guys are making me dizzy.

I’m glad you’ve finally come around. Customer owes 24 payments of $1,206, including the rebates. This confirms the dealer is swallowing the rebates. You cannot owe $28,944 of total payments, without the dealer vacuuming up cash.

Step back from your math for a second and look at the forest. $65k - $15k - $3k = $47k sales price, big picture. Take away the $35k residual, zero interest. That’s about $12k of total payments owed. That’s $500 per month, rough math.

Whether the dealer is intentionally screwing the customer on purpose or on accident - it doesn’t matter. The cost should be about $500 or so per month, including the rebates, using their alleged dealer discount.

Perhaps you need to read my entire post. The calculations you see are intermediate calculations used to compute the single pay.

24 pays of 1206 each does not include the rebate. All this shows is that you don’t understand the math.

No, it’s the math that proves my claim. I’ve already done the calculation that you described…

If it were structured as a traditional monthly payment lease and using the rebate as a CCR, the payment would be…

Base Monthly Pay = .00001 x (47894.92 + 35629.20) + (47894.92 - 35629.20) /24

= 511.91

Monthly Pay = 1.06276 x 511.91 = 544.04

Lease Inception Fees…

1st payment 544.04

CCR Tax 938.26

DAS 1482.30

I’m a mathematician and taught graduate level financial mathematics as well as a former Actuary. I can do this stuff in my sleep. Anyway, either you see it or you don’t.

@delta737h I’m originally born and raised in Kent. Graduated from Kent State then moved down to the Wild West of Florida and their insane doc fees. Yes, bring back the Indians!

KSU is a great school. My brother graduated from there in '74. Come back home!

It’s mind boggling how much energy was wasted on arguing over the “right” way to deconstruct one of the worst quotes ever presented on LH

I agree and tried my best to educate people. Apparently, I failed to do so. For those not familiar with this desking software, it can be very confusing. There is no question, however, that this is a single pay lease. The monthly payments are only intermediate calculations used to compute the single pay amount which is the way it’s done. The rebate can be applied in one of two ways (1) as a CCR or (2) applied upfront as a deduction to cover, in part, the single pay amount to arrive at the DAS which is exactly what this dealer did. In fact, it says so on the dealer WS…

The dealer did not screw the OP out of the rebate. People zeroed in on the monthly payment and erroneously assumed it was a monthly payment lease and that the rebate was never applied as a CCR focusing on the 62844.92 net cap thinking that is should be 62844.92 - 14950.00 = 47894.92. They erroneously concluded that the monthly should be much lower and that OP got screwed out of the rebate. Good grief!

Again, this is a single pay lease where the rebate is applied upfront. What is it that these people aren’t getting? Geez Louise!