Is there a way to avoid paying upfront taxes on sales price? Looking for a legal loophole. The taxes are just killing my lease deal.

Any advice is greatly appreciated.

Ask for tax credits.

I have been told by multiple dealerships that this is not at their discretion. This something only BMWFS offers and usually at year end.

Either they are lying or I had two dealerships offer me tax credits out of their own pockets. However, both of those were one one pay options, so maybe that is the key.

It might be that they’ve used up all the credits they had, it’s hit and miss as normally it’s based on the dealership or the dealership chain.

What vehicle are you going for? If it’s a PHEV vehicle and you’re going with Owners Choice tax credits aren’t essential for a great deal.

340i.

Working with Dave who is one the best registered dealers on LH. I just sent him a mail asking for tax credit. Keeping my fingers crossed.

Dave in California? How are you expecting to get Texas state tax credits from a California dealer?

The problem is though you can’t get tax credits from a dealer that is outside of Texas so you will always pay the full 6.25% tax on the sales price for out-of-state. That’s why I normally caution anyone in Texas from buying out of state as even with a higher discount rate, when you factor in not getting tax credits and delivery then it’s often not worth it.

I see about 30-40 340i in Texas at the moment, I’d be surprised if none of them will cut a good deal.

Thank you both for your clarification. I will try to call around and see if anyone is willing to give tax credit.

I have a question regarding lease taxes in Texas.

In Texas we have to pay taxes for the whole car price. my question is: if I lease a Lexus for 3 years then decide to buy it at the end of the lease, should I agin pay taxes for car residual value?

Short answer: no. But if you got Texas sales tax credits: yes.

I don’t think the post you linked is a correct summary of the law in Texas.

My understanding is that in Texas you do have to pay tax on the buyout price when the lease ends even if you did not receive any tax credits. That’s what dealers have told me and also consistent with how I read the statute.

Section (b) and © of the linked statute appear to create confusion for some but I think those provisions do not apply to your standard car lease. Those sections apply to leases that are re-characterized by the tax code as a sale rather than a “true lease.” Basically, this prevents a loan from being disguised as a lease because leases typically receive beneficial treatment from an income tax perspective.

I think most standard car leases would clearly be “true leases” and not sales under the tax code, so Section (d) would apply and the lessee would have to pay tax on the buyout price of the vehicle at lease end if they decide to purchase it.

It wouldn’t surprise me if that’s the case, that’s what I was told originally but so many other people recently have said different. If anyone gets their lawyer to analyse this I would be interested in the briefing so we could settle it definitively.

This is where BMW Owners Choice is a major plus, it puts the vehicle in your name so no risk of paying the double taxation.

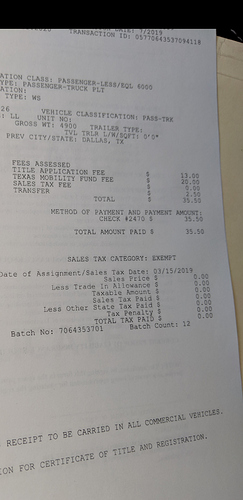

I just fought this battle with the Dallas county tax assessor and won. The statute is linked in the link AJ posted. Take that tax office. If they won’t listen contact the tax assessor directly. If you are forced to pay tax again, send your documents along with the law to the state comptroller and they will send you a tax refund check.

There’s also a tax lawyer in Houston that will help.

Nice job pushing that through. I think that’s an aggressive position to take but that’s great that you won the argument with your local tax office. I am a lawyer and personally wouldn’t be comfortable taking that position for a client and I think it would be a losing battle if it actually ended up in front of a judge.

But then again, the statute is not that robustly drafted and there is some room for different interpretations. If you have positive equity at the end of lease (fair market value > buyout price), you could possibly make a good faith argument that no additional taxes would be due but I don’t think that is what whoever wrote this Texas law intended. I think that if a judge did a serious analysis behind the intent of the provision and compared it to more robustly drafted federal statutes that address this same concept, you would get the opposite result (i.e. double tax).

Respecting your insight, but the only person/people that agreed with you and disagreed with me were the clerks in the office. The state comptroller’s office took the plain language reading of the law, as did the Dallas county tax assessor (which being an elected official took some time to get to).

Fortunately for those in Texas there is an attorney who will take that position for their clients.

https://ansaritaxattorney.com/texas-sales-tax-car-lease/

Further as a matter of equity, I would think a judge would plainly see the lessee turned buyer already paid the sales tax on the item once. Charging it again is wrong and changes the type of tax.

That’s great the tax authorities are taking that position and I hope that gets applied more broadly. Good on you for pushing this forward as it obviously is a better result for us taxpayers. I still think the statute, though poorly drafted, supports a double tax on leased cars so I would not be surprised if other taxing authorities in Texas take that position.

Practically speaking, this matter is not going to get resolved by a judge - there just isn’t enough money at stake in any one transaction to warrant the legal fees needed to take it to court.

To your point on equity, it is the leasing company that technically buys the car from the dealer and pays the tax in the first instance, they just pass that cost along to us because we agree to pay it. When you decide to purchase the car at the end of the lease from the leasing company, Texas law treats it as a second transaction. Similar concept if you bought a car new, paid full tax on it, then sell it to a friend, who will then have to pay tax again. Seems like the state is double dipping but it’s just the nature of sales tax that the same item can get taxed multiple times as it changes hands.

This is why tax credits from leasing companies are so helpful to get a good deal in Texas because the leasing company eats the cost of the initial tax (or offsets it with some tax credit they have on their return) instead of passing that cost along to us.