Nice try, but I think you have really bad idea who I am if you think I will let any $cumbag out there to shut me up at their will. MF is an interest paid to bank for fronting money and buying a car from dealer, so you can rent it. It’s silly to deceive yourself and imagine you don’t pay interest on rent, so you can comply with usury laws in your religion.

You are welcome. Use lease calculator and check all rebates/incentives on Edmunds dot com forum, plug in MF, RV and tax rate on lease for your state to figure out what amount of discount you need on selling price to get that car at $350 or less per month, with first month payment only DAS. Then call around and ask which dealer can do it for you. Did you already turn in your 21 Rogue?

Not yet, still have until May. The buyout on it is around 17k so I was planning on keeping it since we got to the point where we need 2 cars. Has some decent equity on it, but if I were to sell it or trade it in I wouldn’t get a car with the same features for 17k lol

Here is black book value for 21 Rogue S without any adjustment and, obviously, not specific to your car since I don’t have your vin and don’t know condition of your car. Are you sure the buyout is 17K?

If you have any equity on it, you can transfer it to new lease as a down-payment (see my closed threads for Jeep and VW I leased recently), but you should first try to get the best deal possible without mentioning your car. Bring it up after you have a deal on new car, so you can further reduce your payments if that’s the route you want to go (by utilizing the equity on your current car). But check your lease contract for Rogue first, it may or may not allow third party buyout.

Thank you I really appreciate your insight. the buyout is 17,313.00 before a 300 buyout fee. just surpassed 40k miles on it so I am guessing will be getting around 25-24 privately. This looks like a useful calculator, what is its name if you don’t mind me asking?

![]()

![]() Care to answer.

Care to answer.

Sorry, minmum 10k miles a year

So your logic is there are two interests in each deal? Hmmmm lol ![]()

![]()

![]()

What do you mean “two interests” in each deal?

You said there’s interest on top of the rent charge. Rent charge is interest already. I think that’s what @Jon was trying to ask you. The way you explained it sounds like 2 types of interest in one deal

You are correct, good catch. What I mean is there is interest (called ‘rent charge’) on depreciation. The actual formula is even more complicated, rent charge = net cap cost plus residual times money factor. But who cares when you have lease calculator to do exact math? An interest is interest, it’s paid , whether you call it MF or rent charge on one or another part of the transaction. That’s the essential part of my message (if OP can lease, then why not finance, if it’s better financial option for him?).

There is lease calculator on LH, you can click on ‘lease calculator’ tab on this site. Autocompanion also has a calculator on their webpage, which populates incentives, taxes, MF, RV for most makes and models they trade. Edmunds dot com has dedicated to each make/model forums where you can ask in real time about current incentives, MF and RV under terms you look for. Most of the time those questions are already answered, if you browse specific threads.

It’s the same thing. You borrow capital, the cost you pay to borrow capital is interest. Doesn’t matter what other name you apply or an institution pretending to be friendly to your religion applies.

It’s the exact same thing with leasing. They are earning interest on their capital with no greater effort than an auto loan.

While I agree that financing is better, I am not the best at explaining, nor am I an expert. Qualified scholars are better at explaining the difference. leasing is more of an exception than the norm when it comes to how we deal with interest. there are a couple of main areas that make leasing and the interest on it not prohibited. 1: I am not the owner nor will I be once the contract is over. So I am not the one carrying the risk if something happens to the car (kinda like renting a house) 2: the final price is agreed upon, as in it won’t accumulate interest (the rent fee aka the interest in this case is charged upfront). yes, both are types of interests, but they are not the same from a religious standpoint. I am not an expert so I am not doing the topic any justice since it has way more intricate details.

As for the question of why we won’t finance even if it’s a better option, I like to think about it this way, if a pound of pork is 3$ and a pound of beef is 5$, I still can’t go eat pork cause it is the better financial decision. They are both sources of protein, just like both loaning and leasing have interest.

Meaning you were wrong (again) and were called out for it, but doubled down on being wrong repeatedly in response to @Jon

Same nonsense, more incorrect info - just a different day.

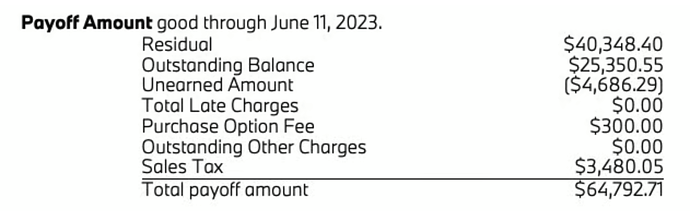

The interest is not charged upfront, it is earned monthly, that is why when you buyout a lease early, the “unearned interest” is subtracted from the lease payoff.

See this example from a BMW payoff 2 months into the lease, “Unearned Amount” is the interest that hasn’t accrued yet:

Note please that I am not trying to argue with you, and I respect that this is a limitation of your religion, but the point I am making here, if anything, is to tell you that if it really is important to you to not violate your religious laws, leasing still is not some workaround for paying interest, it earns monthly like any other loan.

With all due respect, but do these scholars have a line or verse from 7th century where the car lease was compared to auto financing? I assume not (and you can correct me if I am wrong). As poster above mentioned, you will be paying interest on capital borrowed, whether you call your transaction MF/lease or interest/finance. As such, lease does not provide a workaround that would allow you to avoid paying an interest.

May is a lifetime away - lot of deals, incentives will change by then

Ideal time would be to start this process end of March

And I appreciate it. I personally didn’t know the intrest was charged like that. I would look into tbe topic further.

Obviously no, the quran stated what is allowed and what it not. It does mention different types of intrest which most are prohibited. But this reminds me of what the prophet (pbuh) said about how a “A time will surely come upon people in which none will remain but that he consumes usury. If he does not consume it, he will be afflicted by its dust.”.

I do appreciate it that you guys are explaining the topic more to me because my understanding of the topic isnt the best.