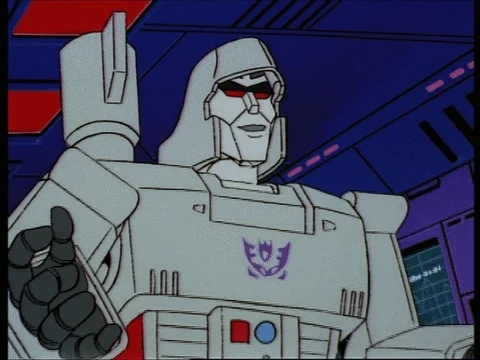

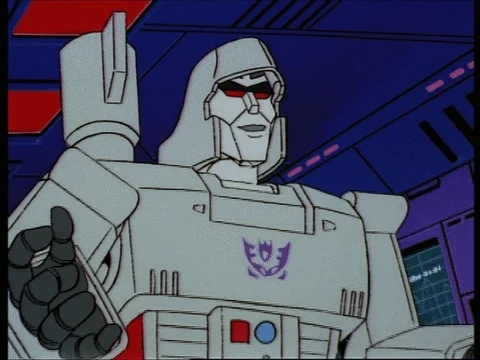

Those are new ones though. You aren’t personally up to your eyebrows in $90k of chunky, rechargeable Decepticon

Those are new ones though. You aren’t personally up to your eyebrows in $90k of chunky, rechargeable Decepticon

When should we expect XM discounts?

After the exporters get theirs (just not from us)

Yeah that’s true. Dealers told me that the number of sales has been decreasing due to the high interest rate and used car value significantly dropped, making the trade-ins quite difficult— hence the entire transaction trends changed.

Not sure if this is my personal observation but I think that people are downsizing because of recession? My local Hyundai dealers agreed to pay 83k for my trade in so I want to act fast and sell it while I can. I might just buy a Palisade Calligraphy and enjoy paying less monthlies.

Tesla really threw a monkey wrench into things at the end of last quarter with their instant rebate promo, makes it a little harder to move the BEV line.

Are you sure this is right? I don’t think OP was talking about buying out the lease. He wants to return his car to his local dealership and have them buy it from him for buyout price. Then he turns around and in an apparently arms length transaction buys it back from them, while giving them a quick profit (I’m assuming this is what he meant cause in a lease buyout dealer isn’t making any money). OP then benefits from federal and SCE credits.

Sounds like fraud but hey people have gotten away with more egregious stuff.

I don’t think it’s fraudulent - what CA law or IRS regulation would say this is illegal. There are valid reasons one could want to do this, say if you want the car CPOed and the easiest way to do that is to have the dealer buy out lease and then CPO when you purchase the vehicle back from them.

Importantly, OP didn’t get the tax credit previously. That went to leasing company. I agree if OP previously received a tax credit for this car than this scheme would be fraudulent.

I would be all over a low-mileage iX if I could buy one under $70k, let’s hope the market truly gets flooded with them ![]()

None of this matters. It’s tied to the person, not the transaction. It could go through several dealers (as long as no one claimed the tax credit) and it still would be a no go, since hes the one that initially put it into service.

The only standing here would be to argue around the "tax payer that put it into service " definition… although note that the languages doesnt say “the person who purchases it”. It specifically differentiates.

Used EVs are probably going to sell at a premium due to the credits/rebates available.

According to the IRS, you need to buy the vehicle from a licensed dealer, and not be the original owner.

Here, you are not the original owner, the captive/bank is. So as long as you buy it from a licensed dealer, you should be ok.

I recall reading that some captives want the dealer involved in the lease buyout process. I do not know who is listed as the seller in those situations. If the local dealer is listed as the seller, you should qualify.

Have you looked at IAAI?

The law does not say you are not the original owner.

It says the original use of the vehicle must commence with a person other than the taxpayer.

This is written very differently than specifying original owner (which would be the lessor) instead of the user.

We are getting into the weeds re statutory analysis. The language on used cars says “the original use commences with a person other than the taxpayer with whom the original use of this vehicle commenced.”

I can see your point that the “use” is as a vehicle for the taxpayer and not a rental car for the finance company. That reading means there is no difference between financing and leasing for “use” purposes.

Whatever the verdict, this sentence is poorly written. If I was the only one on the title, I don’t see how this law precludes my spouse or family member from engaging in these shenanigans. They wouldn’t be the taxpayer that put vehicle in service. Also, “person” really should not be singular here when you can, and often do, have two people on the title. In that situation, I assume they are both the “taxpayer” but the law doesn’t reflect that.

I agree it definitely doesnt seem to prevent a dealer buying it out and then reselling to a family member. It does seem to limit you doing it yourself though.

Just checked with Hyundai Motor Finance if they pass the EV credit towards a lease. The bank said yes, they do pass the EV credit, but also said that I need to talk with the dealers. Local dealers have no idea what I was talking about. But one said, he will check.

I also read an article that currently 5% of the Hyundai EVs are leased, but they want to push it up to 30% leased. They may actually pass the EV credit… then Ioniq 5 will be more expensive…

I don’t understand how this would be up to the local dealerships. Wouldn’t the $7500 credit be presented as an available lease incentive across the brand?

Yeah that’s the issue. I think it is too new to establish a solid set of guidelines as of yet. Or Hyundai may not want to pass the EV credit on Ioniq5…

I was looking at the IRS guidance which states:

“To qualify, you must:

I would argue that the IRS is taking the position that the captive/bank that initially bought and then leased the vehicle is the taxpayer who initially used it in their business of leasing vehicles. This interpretation is consistent with the section 45 guidance issued by the IRS that allows tax credits to captives/banks that buy and then lease vehicles as part of their business.

Nah. It is either an incentive offered by the bank or it isnt.

The dealer isnt involved.