So where did your idea of hundreds of thousands come from then?

You think being ignored by a dealer caused substantial damage? If being ignored was cause for legal remedy, there wouldn’t be enough lawyers on the planet to adjudicate every claim. If the bank is able to resolve the credit ding, then there is absolute no loss on the part of the OP. The only payback is via complaints and bad reviews.

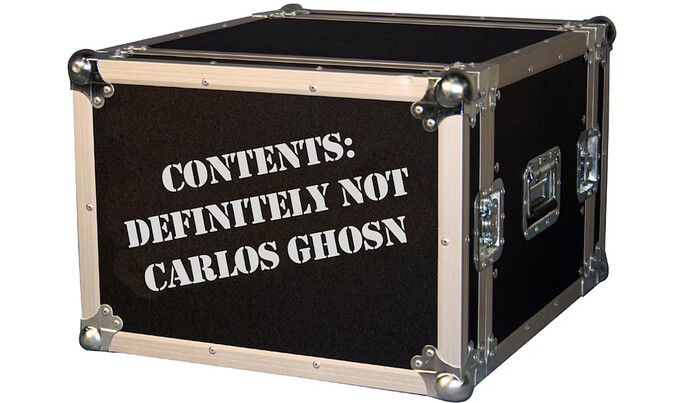

Ahhh, so you bought a Nissan and got the full “brand experience”.

Call your local TV station consumer advocate.

Ha, I love this idea.

No where, it is just a thought. When you have a situation regarding damage loss caused by others, it is always not a bad idea to consult your lawyer.

I’m feeling quite lucky right now. I grounded my Frontier lease at Tustin Nissan on June 12th. Luckily they processed the grounding paperwork right and Nissan closed the lease without issue. I did randomly have 2 toll road charges on the car 4 days after turn-in. I fought those and the TollRoads removed the violations.

I deal with these type of issues in my business. Please Do NOT wait for Nissan to remove it from your credit. They likely will not do it. Further, they have already shown that they cannot be trusted to handle your account without nipping at thier heals. YOU need to dispute the errors will all three credit bureaus. Dispute bureau each in writing certified mail return receipt. That way the Credit Bureau will have to investigate the disputed errors and hold them to respond timely. if Nissan cannot prove otherwise then Bureaus will need to remove the negative marks. I don’t know if there was anything unsavory going on with the missing car, but if you feel it is then definitely inform the bureaus of that and include a copy of the police with your disputes. Document and keep track of everything. Let us know how it goes.

Hi @Mizpah - I appreciate this feedback. I don’t know why I was thinking Nissan should be trusted to handle it going forward. I have disputed the account on all three credit agencies this morning. Thanks.

Ironic, Nissan is billing me $242/month for the car according to credit agencies. I would have loved to just kept the thing at $242/month.

Similar story on my one pay thru GM. Car wasn’t grounded and I got letters and calls asking for payment. Dealership failed to send paperwork to GM financial.

Resolved quicker than yours but still a pain in the ass.

I saw a guy standing across the street from a Nissan dealer with a huge homemade sign saying “-------- Nissan screwed me” I wanted to stop and interview him but I didn’t have time.

For anyone following along, the last supervisor at NMAC who I thought would handle this has ghosted me. I’m starting over with someone new. Thankfully, per the suggestion here, I have also reported to each credit agency for them to review.

Also, NMVB didn’t care.

@Heavycream I’m thinking of getting into business mass producing those signs

May no longer be with NMAC; turnover is high

If you are looking for other suggestions.

Send an email to the Nissan CEO asking for executive support. His email is

makoto.uchida@nissan.com

Open a BBB complaint with NMAC, they appear to be responsive.

Nissan Motor Acceptance Company, LLC | Complaints | Better Business Bureau® Profile (bbb.org)

This will usually get you some kind of escalated attention.

12 CFR Parts 1001 and 1090 also cover actions managed through the CFPB (automobile leases).

Submitting a CFPB complaint against NMAC should get a response.

You need to watch your soft pulls from insurers whilst credit is for shit …rate jack for certain

Interested in how this ended for you as I am going through the EXACT same thing with Infiniti of Melbourne FL for TWO leases returned in early November.

Credit dipped 100 pts for about 2.5 months. No one from Nissan or any other places I called or submitted reports to care. The dealership didn’t care aside from eventually grounding the lease under threat of a stolen vehicle report.

Total side note that doesn’t apply because you (like me) don’t have access to the car: It was a killer Nissan Frontier lease deal from here, and the payment NMAC wanted from me for the car I didn’t have was only about $180/month. I’m not sure that was ever a real option, but I would have loved to have kept the car and paid them the $180 for another year or two.