DCU shows a lease buyout option, just did it last month

Pretty sure it’s a Used Car Loan. In process of buying out my Volvo lease and plan to hold it max for another year until the 4 year factory warranty runs out. Rates I was getting quoted by VCFS for Tier 1 Credit was Used Car Rates (4.2% or so for 5 years). Ended up doing Used Car loan with PenFed and am waiting for the check.

DCU has two auto loan applications, new and refinance. Select new for a lease buyout.

Looks like the rates were updated last week, now is 2.49 up to 60 months.

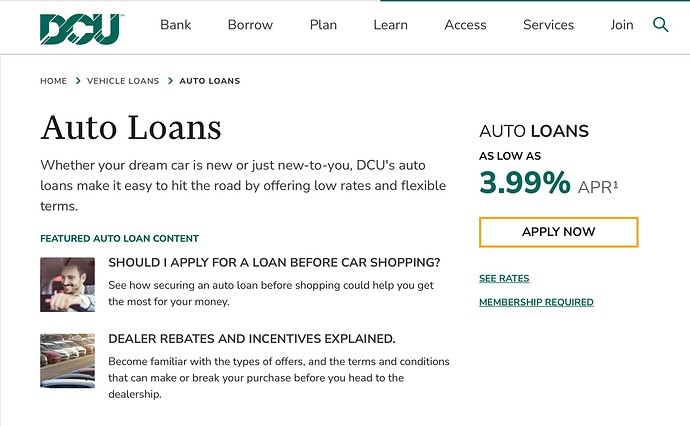

Now 3.99%.

I closed mine at 1.49%.

Currently earning 1.8% APY on liquid savings (and checking) at SoFi.

How quickly things can change…

Do you recommend sofi?

Have mine with penfed I get 150 bucks a month on and they at 1%

SoFi currently has a sign up bonus if you decide to go that way…do a quick Google search for it.

Bask Bank ( part of Texas Capital ) is at 2.02 on savings. Currently thinking about getting a 90 day T bill which was at 2.44 or so pre this week.

Do you use bask?

Yes. Currently I have the account that pays you in AA miles that I set up a few years ago when rates were at 0 and they had a 6000 mile sign up bonus.

About to open one that does the 2.02 rate though unless something better pops up or I try a 90 day T bill w/ those funds.

The bank is fine, fairly pedestrian website but no issues. Texas Capital is FDIC insured so all good on that front.

Yes, in particular their same-day ACH transfers are completed in a couple of business hours.

And they pay the same APY on checking (I’m not using the checking account, but they don’t offer just one account or the other, you have to take both).

Also they have new account bonuses as @ApexHunt notes.

I need to update the subject line.

While I do that, there’s also a thread discussing where to get strong financing deals elsewhere:

You can refinance it if/when the rates are lowered. But the feds are going to keep raising rates and it doesn’t seem like it will stop soon. Target is 4.5-4.75% and it is currently at 3-3.25%. Even once it tops out, they aren’t going to magically lower it overnight.