Keep in mind you’re taking that $10k and then paying sales tax and rent charge on it, so it’ll quickly become more like $12k.

Thank you for all the help. Here is what I came up with…I checked my payoff and it’s 37,500 so maybe 8k isn’t unfeasable.

Good luck!

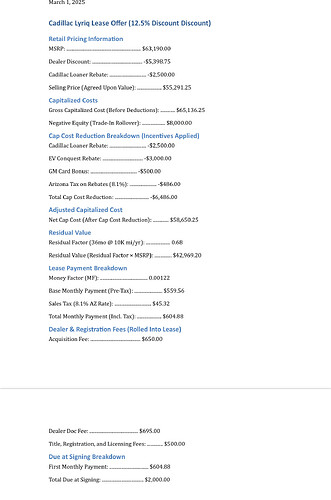

EDIT: Why would you treat the 8.1% tax (486) levied on rebates as a cap reduction? That should be capitalized or, preferably, paid upfront to avoid tax on tax. Also, I would not roll (capitalize) the title/reg./license fee into the lease as that would be subject to a finance charge and tax. These fees are not taxable if paid upfront.

Using the 486 tax as a cap reduction throws off your monthly payment because your adjusted cap is too low by 486 meaning your total monthly payment is too low by 15.24.

I have no idea how you got 2000 due at signing. Nowhere do I see the 2000 used for anything. The only due at signing should be your 1st payment (620.12), title/reg./license fees (500), and CCR tax (486). Total due: 1606.12, not 2000. The formatting could use considerable improvement as it is too hard to follow.

I suggest you peruse the LH online tutorials Leasing 101 before proceeding further.

This topic was automatically closed 60 days after the last reply. New replies are no longer allowed.