I don’t disagree (hence I have $250 deductible for comprehensive coverage myself), just trying to be illustrative for this particular example. Also, not trying to be semantic, but since you can set different deductibles for collision vs comprehensive, the higher deductible for a cardboard fire vs fender bender would be two different things. But I take your point, since my example covered total loss only.

Can you just ignore it already?

Well, at least there was a good discussion and screenshots of everyone lease contracts regarding total loss. I’d save this thread just for that.

I’ve seen enough of dumpster fires otherwise… pun intended.

You aren’t even paying attention. It was a cardboard fire!

Thanks for donating. It is greatly appreciated. Sorry you were in an accident.

Thanks, completely get it now. I thought about it and it Makes perfect sense.

You have nothing to worry about. You will get a check for the equity in the mail, it’s yours and not BMWs. This situation has played out many times before here, including with BMW, and everybody got their check even after being falsely told they would not.

Ironically, I think it’s more of the wealthy that are particular about being properly insured. Mitigate/hedge downside risk at an acceptable upfront fixed cost since they have more to lose.

That’s a bit extreme but using same principle anybody can increase his/her deductible and save serious $$$ over time.

Same language as mine, not surprisingly. Which, makes me very glad I have agreed value coverage.

If BMW is really going to keep the upside on the insurance payout, why not just exercise your buyout option immediately before the insurance claim is settled? Now you own the car and get the upside. At least the threat of that should be enough to extract a reasonable split of the upside from BMW.

When I totaled by BMW lease in 2011 the insurance payoff for the vehicle was higher than the BMWFS payoff. The insurance company cut two checks. One for the vehicle payoff and the excess to me directly which included a prorated amount of the taxes I paid upfront on the vehicle and equity.

Quote possible things may have changed.

This is wrong,

In case A lessee owes $500 to FS

In case B lessee owes $2000 to FS

Which will go to collection if lessee does not pay.

That is the whole point of paying slightly more monthly to have less deductible.

I disagree. Though it depends on the payoff and assumes there’s GAP if there’s a shortfall.

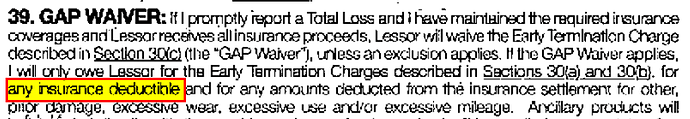

My last lease (Acura) had language that in the event of a total loss GAP kicks in, but I would have to pay my deductible to the captive. Maybe this is what @amin is talking about?

My current BMW lease:

GAP will kick in if there’s a shortfall, that shortfall does not include your deductible. If your car is worth $22,000 and the payoff is $24,000 and you have a $500 deductible, you still have to pay that $500 deductible, but you aren’t responsible for the other $1,500

Look at the text people have shared. You’re contractually obligated to inform BMWFS immediately if the vehicle is wrecked. Plus, I think things would get very screwy with the insurance if the vehicle changes hands while totaled.

I hope someone does this and the court settles things and make a precedent.

I don’t have a BMW lease, so I can’t comment on the specific language at play here. But if the OP has an obligation to inform BMW about an accident, he can do that. That would not impact his ability to exercise his purchase option absent some other relevant provision in the lease agreement or applicable state law.

My Ally lease has nothing in the sections discussing my purchase option that would indicate I cannot exercise that option after the vehicle has been damaged or even totaled. The language is very straightforward: “You have an option to buy the vehicle.” It then goes on to outline the price if that purchase occurs during the last month of the lease, and if it it occurs during an earlier month. Nothing at all regarding damage to the vehicle, other than to say that if you buy the car you don’t have any responsibilities for other charges (excess miles, damage, etc.).

If it were me and there was $13k up for grabs, I would give it a shot!