Another factor to consider when choosing a captive/brand then.

Since chevy has stopped buy out’s I think you’re on to something ![]()

I’d like a good explanation why BMW should get any money beyond the contractual payoff. Unless it’s in the contract like the Hyundai one above, OP owes BMW what the contract says buyout is.

Just checked my audi lease. It also has language that insurance proceeds go to the bank.

@ethanrs How did you feel about signing the lease on the first Porsche flip. IIRC you signed knowing there was about 20k in equity. Wouldn’t all the above discussion about not Owning the car thus not entitled to over insurance payment apply to you too?

… that has…

so,

There’s nothing else to say (aside from ultimately contacting an attorney, if OP can’t find any language in the contract about this and if they are that angry about the “lost” $).

I think if he pushes them with a light legal threat, they will give him the money, or at least split the difference.

If there is nothing in the contract stating they get it, I doubt they are going to want to deal with legal over $13k.

I am curious if he has an argument against the insurance company, anything above the payoff shouldn’t have been sent directly to bmw, it should have been the policy holders money.

The title is impressive. OP hope it works out for you.

So glad we owned our Mazda6 when my wife totaled it. Wait a minute…

So? This is a helpful thread to see how this one ends, considering there is no clear answer other than when the contract spells it out. Some people get their equity back and some don’t.

So then open it back up if/when the OP provides the final resolution.

This is a discussion where some posted their different experiences from the majority demanding to close the thread. Who’s right? If there is no clear answer, then it should stay open, even if asked “million times”. I, personally, want to learn as much as I can.

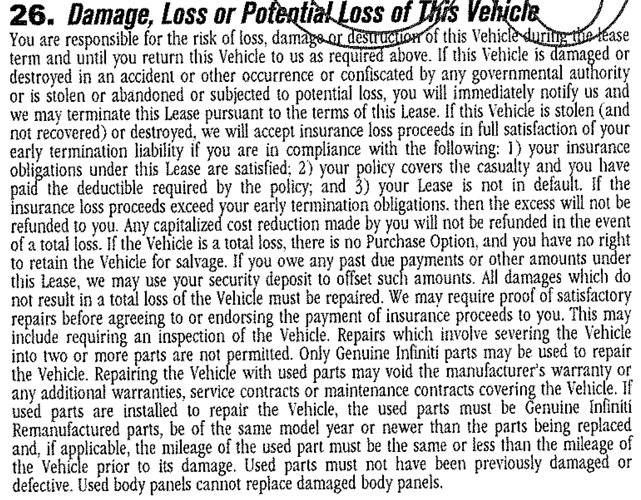

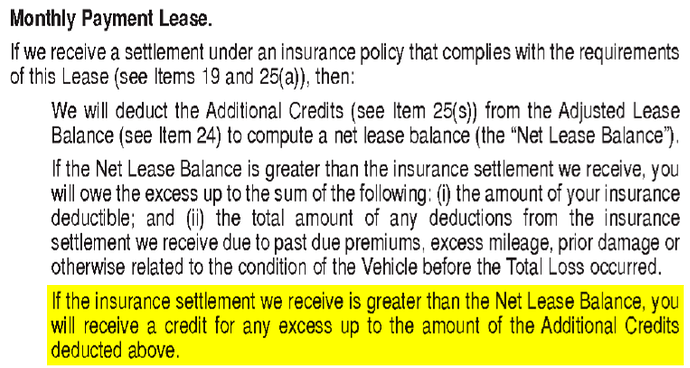

Looks like my Infiniti lease is pretty clear on this. They keep all insurance proceeds and get to keep all down payments.

TIL - I always thought lessees got the excess.

All the more reason never to bring any cash to signing.

People with large down payments who get their car totaled early in the lease are in a bad spot.

The only argument for upfronts/CCR is paying the absolute possible minimum tax and rent, which I applaud — I am just not that lucky.

I was driving my first lease home from giving blood (“down a pint” as a friend used to say), and a 65 year-old Reverend rear-ended me on a sunny afternoon, in a 25 MPH zone, with no sudden stop or weather/pavement issues.

Occasionally, even when they send their best, they miss. I am glad to tip Brian Moynihan a few extra dollars to take that risk for me.

I am shocked at the fact that some people are defending BMWFS and educating me about property law. What about contract law? I have two contracts signed. One with BMWFS and one with the insurance company. The one with BMWFS said nothing about the overage, and even if I set the fire myself without any insurance, they can go after me for maximum the remaining payments and RV. I paid premium to have lower deductible from the insurance, and now that saved deductible is BMWFS’ to keep? Absolutely absurd.

This is not my greed. It is the corporate greed.

There is no reason to take the fight to us, but to your insurance and BMWFS. Pull your contract and read what it says in the case regarding such event. If it does not specifically mention over payment due from insurance (that you stated is the case), then you might have some legal grounds to recover the difference if you get a lawyer involved.

At this point, if not your greed, then you should not care what the insurance pays to BMWFS. As long as it is not costing you additional money that you were not already aware of and agreed to have paid prior to the car loss as this was a lease versus your ownership. Same principle if you were to drive the car to lease end and return it (least you won’t have to worry about tires/damage/dispo fee now) as nothing would be returned to you (except MSDs).

Closest you can do is have a large deductible assuming you expect the car to be worth far more then payoff (safe bet in today’s market but not otherwise typical), as the insurance co reduces the payout by the deductible amount before cutting a check.

I think my lease required a certain deductible and coverage limits.