so they finally explained to me the price discrepancy. Their pricing model incorporates every incentive out there to get that price (even ones you are not eligible for). The easiest way for them to fix this is just put starting at their price vs saying that’s the price.

That’s not the real reason, and everybody hears some different story as to why they can’t meet the made up prices they plug into their app.

For the car I was looking to buy, the price difference between the Honcker app and the reality once they called me was $100 more. There were no issues with incentives, they just made up a price.

The solution is for them to stop the bait and switch and just get real prices from dealers. They claim to be a marketplace in their own marketing materials, but they are posting made up numbers that their ‘dealer partners’ aren’t able to meet.

What is going on with Honkers, every car is at least 2-3k more expensive for the term of the lease , compared to the prices they had during last week of Feb.

Now they added make an offer , which means it back to old school car buying.

Make an offer seems to have broken Honcker. Just before this “feature” the car I was looking into (now ready to lease) was at the lowest I have seen it. This was in March. When make an offer showed up the price went up $40/month and is now above my better local deals.

I placed Make an offer on 2 different cars with slightly different lease rates (same MSRP) so I imagine they are from different dealers. Did this yesterday morning. Still waiting for a reply on either one. Doesn’t bode well for a quick and painless process. I offered the exact number that was on Honclker before the make an offer option was available.

Or maybe they fixed the glitch causing the price to be 40/less than it should’ve been to begin with.

Just posted on another thread but I made an offer on 2 cars presumably different dealers for the exact price that was listed before make an offer popped up. 24 hrs later still waiting to hear from either one?

No need to bump two different threads with the same

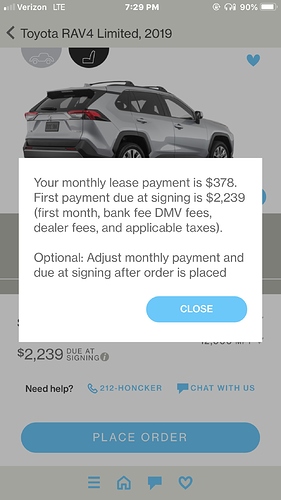

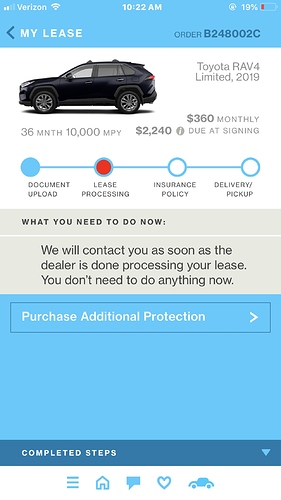

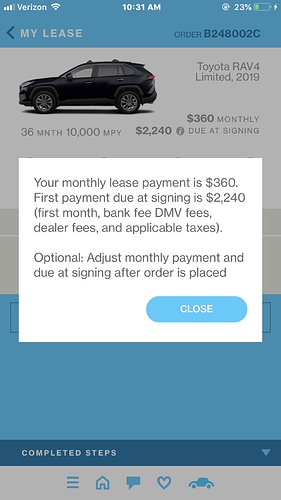

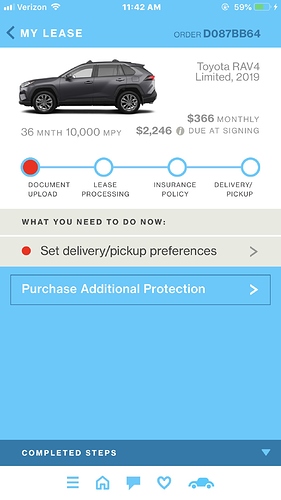

Very similar thing happened to me a few weeks ago. Ordered a car (impossibly low price listed) for a 2019 RAV4, which there are no real “deals” on because it’s so new. Was told car was reserved and processing. Credit score 800+. About half an hour later was notified that the car I chose had already been taken by someone else. So I chose another one and placed the order. Shortly thereafter I received a phone call saying most aggressive price dealer could do was about $40 more PER MONTH with same amount down. Asked why and he said prices listed are NOT actual prices, but the best price someone else was able to get. Told them their site was a scam and deleted app. See pics below.

This is crazy! I would be so pissed if someone ran my credit and raised prices.

They do not run credit until a a deal is agreed upon. I tried the app and it was a complete waste of time. I placed an order and was told the price would be much more but I confirmed the process with Honckr and credit isn’t run until you and the dealer agree.

Which means there’s a possibility dealers can be deceiving clients who are at borderline credit tiers?

the thing is a colossal bait and switch.

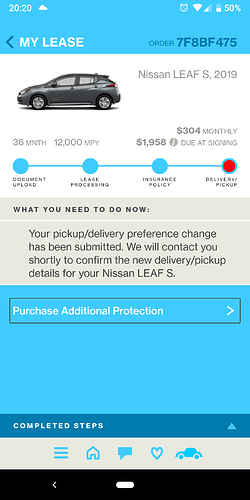

Last week I thought I found a great deal through the Honcker.com app. I’ve been in the market for a lease on a 2019 Nissan LEAF and thought I found this great deal.

The deal was:

Monthly payments: $304

DAS: $1958

I talked to a few dealers who all said it was a great deal and so I decided to take it. As soon as I clicked on the deal, provided all my personal information and uploaded my driver license my credit was polled. It was a hard inquiry on my credit. I checked my credit and saw a new hard inquiry. At the end of that day my order was just waiting to be delivered:

The very next day a customer representative named Ari Cohen called me to inform me that the deal does not exist. He was very rude and pushy trying to get me to accept the new deal which was now $330 a month before tax. I rejected and asked to talk to a manager. He said a manager will call me the next day.

After two more days where they have not reached out I called them back to talk to a manager who was not available to immediately talk. A couple of hours later one of the VP of Sales at Honcker called me. His name is Talles Guimaraes who again explained that the deal doesn’t exist. He further explained that this is a common situation and usually the customers like the new deal even though it isn’t what they accepted. He basically admitted to the fact that their business model is the classic bait-and-switch.

I tried to challenge the fact that my information was given to the dealer before they had approved the deal. Talles Guimaraes explained that it is how their system works (whatever that means), and they can’t validate every deal. I tried suggesting that they could have the dealer confirm the deal before getting the customers information, but it was obvious that the conversation wasn’t going anywhere.

In summary, the numbers on the Honcker.com app are either a bait-and-switch scam or simply not a good lease offer.

Avoid at all cost!

Did Ari post a middle school picture in his LinkedIn account?

Sucks to hear. We have been waiting for months to get added as a dealer. The dealer does control the pricing so it’s up to them the be honest and upfront

While I agree that the dealer is responsible for being honest and upfront, it is my opinion that Honcker has the responsibility as the platform owner to enforce that. It would be extremely easy for Honcker to add to their API a final confirmation of the offer by the dealership before they get the information.

It’s a matter of caring about their customers’ personal information, which they don’t!

Ouch. I feel like the legal ramifications here are pretty big — sounds like this is a very common occurrence at Honcker. There is no way any company should be able to run your credit and then change terms of the agreement afterwards. Surely there must be someone smarter than me who can weigh in on this — I would be absolutely livid if they were running my credit and changing the terms afterwards. Especially if this is their status quo.

Is that even legal to make a hard pull without an actual willing to make a deal?

How is this different than the dealer pulling your credit before you’ve even settled on price? In fact isn’t it fairly common to check the credit early so they lock you into the 4 square game?